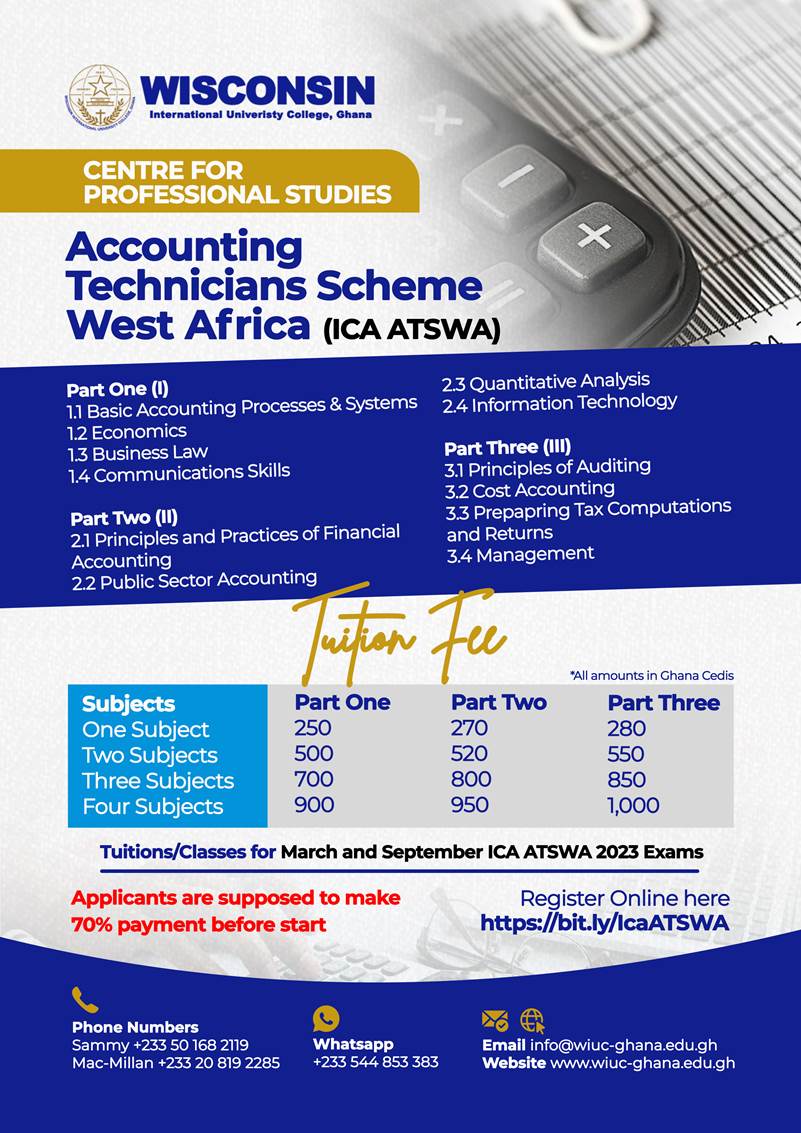

We are pleased to announce the start of Accounting Technician Scheme West Africa (ICA ATSWA) tuition/classes for March and September, 2022 examinations.

Click here to apply Online: https://bit.ly/IcaATSWA

Find details on flier:

Contact persons :

- Dr. Charles Acheampong – 0244 855 759 – charles.acheampong@wiuc-ghana.edu.gh

- Samuel Amo – 0501682119 – sam.amo@wiuc-ghana.edu.gh

- Prince Atsise – 0554807090 – prince.atsise@wiuc-ghana.edu.gh

- Tetteh Samadji – 0243220800 – mtsamadji@wiuc-ghana.edu.gh

Philosophy

To strengthen the education and training, necessary to produce technicians:

- who will play supporting role to the Professional Accountants;

- whose primary duty will be to maintain the accounting system already designed by Professional Accountants;

- who may sometimes work independently without supervision;

- who can adequately meet the needs of the:

– Public sector (including Local Government and Inland Revenue)

– Industry, Commerce, and Audit practice; and - who will be well equipped to advance to the Professional Examination level.

Benefits of the Scheme

The benefits of the scheme to the Accounting Technicians include the following:

- Ability to work and move in all types of business organizations and services within the sub-region

- Possession of a recognized accounting qualification

- Career development opportunities for those who are already in employment

- Exemption from some of the Professional Examination Papers of member bodies’ Institutes and those of other professional bodies.

Entry Requirements

Applicant must be:

- At least 16 years of age

- Fit and proper person to be registered

- Possess any of the following qualification –

1. Six (6) passes WASSCE with aggregate 24 including English and Mathematics

2. Six (6) passes at General Business Certificate with aggregate 24 including English Language & Business Maths.

3. Diploma in Business Studies (DBS)

4. Diploma in Public Finance and Accountancy

5. Any other relevant qualifications approved by the Institute

Potentials Beneficiaries of the scheme

It is believed that the entire economy will benefit from the increased productivity of a well- trained and disciplined work-force. The individual Technician as well as the Organization he/she works for will also benefit.

Specifically, the following are some of the beneficiaries:

- Those holding supervisory accounting positions in Government, Commerce and Industry, Finance and Revenue Departments.

- Accounts Clerks or supervisors in Government-owned companies and parastatals.

- Office managers and audit clerks in practicing firms.

Structure of the Syllabus

Part 1

- 1.1 Basic Accounting Processes & Systems

- 1.2 Economics

- 1.3 Business Law

- 1.4 Communication Skills

Part II

- 2.1 Principles and Practice of Financial Accounting

- 2.2 Public Sector Accounting

- 2.3 Quantitative Analysis

- 2.4 Information Technology

Part III

- 3.1 Principles of Auditing

- 3.2 Cost Accounting

- 3.3 Preparing Tax Computations and Returns

- 3.4 Management

Examinations Dates

- March

- September

Exemption Policy

Exemptions are granted by the Institute

Learning Materials

- Study Text

- Question Bank

- Past Questions

Student's Information (Fees & Charges - 2022 Rates)

| Examination | Level 1 | 85 |

| Level 2 | 100 | |

| Level 3 | 120 | |

| Registration | 80 | |

| Subscription - Member | 200 | |

| Subscription – Student | 100 | |

| Exemptions | Level 1 | 200 |

| Level 2 | 240 | |

| Foreign Level 1 | N/A | |

| Foreign Level 2 | N/A |